Debt Service Coverage Ratio (DSCR) loans are a popular financing option for real estate investors, especially those looking to grow their rental property portfolios. But like any loan type, DSCR loans come with both benefits and drawbacks.

In this article, I’ll break down the pros and cons of DSCR loans in simple terms. Whether you’re a beginner or a seasoned investor, you’ll learn when DSCR loans make sense—and when they might not.

Key Takeaway:

- DSCR loans use property income, not personal income, for loan approval.

- No tax returns or W-2s needed, ideal for self-employed investors.

- Faster approval process but usually come with higher interest rates.

- Requires a minimum DSCR of 1.20–1.25 for better loan terms.

- Great for scaling rental portfolios, especially with cash-flowing properties.

- Not ideal for underperforming properties or those with low rental income.

What is a DSCR Loan?

A DSCR loan is a type of real estate loan where lenders evaluate the property’s income instead of your personal income to approve financing. The key factor is the Debt Service Coverage Ratio (DSCR), which compares the property’s net operating income (NOI) to its debt payments.

DSCR formula:

DSCR = Net Operating Income / Total Debt Service

A DSCR of 1.25 means the property generates 25% more income than needed to cover the loan.

A DSCR below 1 means the property doesn’t generate enough income to pay off its debts.

You can refer to this article for more information.

Pros of DSCR Loans

1. No Personal Income Verification

Lenders focus on the property’s income, not your W-2s or tax returns.

Ideal for self-employed individuals, freelancers, or those with complex income streams.

2. Faster Loan Approvals

Less paperwork.

Streamlined underwriting process.

Often closes faster than traditional mortgages.

3. Scalable for Investors

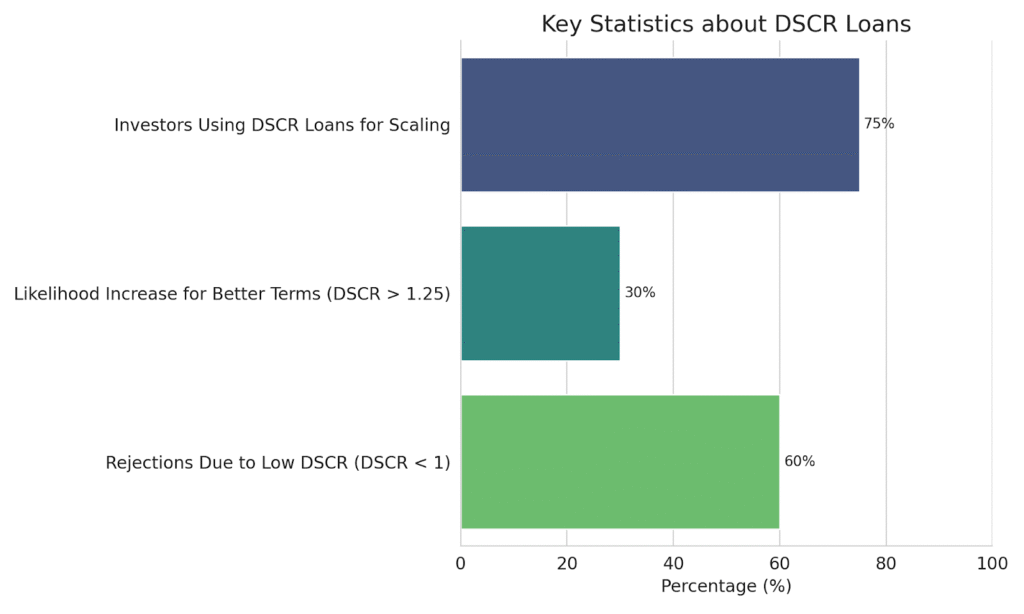

You can qualify for multiple DSCR loans if your properties cash flow well.

Makes it easier to scale a rental portfolio.

4. Credit Score is Less Important

While your credit score still matters, it’s not the main deciding factor.

A strong property with solid cash flow can outweigh a mediocre credit score.

5. Flexible Loan Terms

Lenders may offer interest-only options or 30-year fixed terms.

Some loans allow short-term rentals (Airbnb) or long-term tenants.

6. Use for Commercial or Residential

DSCR loans can be used for:

- Single-family rentals

- Multifamily properties

- Mixed-use buildings

- Small commercial properties

You can learn more here.

Cons of DSCR Loans

1. Higher Interest Rates

DSCR loans usually carry higher interest rates than conventional loans.

Rates vary based on the property’s income performance and your DSCR score.

2. Larger Down Payment Required

Most lenders require at least 20% to 25% down.

Harder for new investors without significant capital.

3. Prepayment Penalties

Some lenders impose penalties if you pay off the loan early.

This can limit your flexibility in refinancing or selling.

4. Strict Property Income Requirements

A low DSCR (below 1.0–1.15) may lead to:

- Loan rejection

- Higher rates

- Less favorable terms

5. Limited Lender Availability

Not all banks and credit unions offer DSCR loans.

You may need to work with specialized lenders or mortgage brokers.

6. No Personal Guarantee Doesn’t Mean No Risk

Some loans are “non-recourse” (no personal guarantee), but lenders can still go after the property.

If the property fails to perform, you could lose your investment.

For more information, check here and here.

Who Should Consider a DSCR Loan?

You should consider a DSCR loan if:

- You’re an investor focused on cash-flowing properties

- You don’t want to use personal income to qualify

- You plan to build a portfolio of rental properties

- You have a property with a DSCR of at least 1.2

DSCR Loan Pros and Cons Table

| Feature | Pros | Cons |

|---|---|---|

| Income Verification | No W-2s or tax returns required | Must show strong rental income |

| Approval Time | Faster than traditional loans | Not ideal for underperforming properties |

| Interest Rates | Fair for strong DSCR properties | Generally higher than bank loans |

| Down Payment | Helps ensure lender risk is low | Requires more capital up front |

| Loan Flexibility | Options for Airbnb and long-term rentals | Prepayment penalties are common |

| Credit Score Requirements | Less focus on borrower credit score | Still matters for best rates and terms |

FAQs

What is a DSCR loan?

A DSCR loan is a real estate investment loan that focuses on the income generated by the property rather than the borrower’s personal income. DSCR stands for Debt Service Coverage Ratio, which is a financial metric used to determine if a property produces enough income to cover its loan payments.

These loans are popular among real estate investors, especially those who own or plan to own multiple income-producing properties. Instead of W-2s or tax returns, lenders look at rental income, operating expenses, and the resulting cash flow from the property to determine eligibility.

How is DSCR calculated?

The DSCR is calculated using a simple formula:

DSCR = Net Operating Income (NOI) / Total Debt Service

Net Operating Income refers to the revenue left after operating expenses (like property management, maintenance, taxes, and insurance) are deducted. Total Debt Service includes all loan payments—both principal and interest. For example, if a property earns $1,250 monthly after expenses and the monthly mortgage payment is $1,000, the DSCR is 1.25, meaning the property earns 25% more than needed to cover its loan.

What is a good DSCR for loan approval?

A DSCR of 1.20 to 1.50 is typically considered acceptable by most lenders. However, the higher the DSCR, the better. A DSCR of 1.25 or above signals strong property performance and increases the chances of loan approval with more favorable terms. A DSCR above 1.50 is often viewed as excellent and may qualify for lower interest rates and better loan packages.

Can I get a DSCR loan with a low credit score?

Yes, DSCR loans are more lenient when it comes to credit scores compared to conventional mortgages. While many lenders still want a minimum score of 620–660, the credit score is not the primary qualifying factor. If the property has strong income and a solid DSCR, lenders may approve the loan despite a mediocre credit score. However, a lower score could affect your interest rate and down payment requirement.

Is personal income required for DSCR loans?

No. One of the biggest advantages of DSCR loans is that personal income documentation is not required. You don’t need to provide tax returns, pay stubs, or employment verification. Lenders only assess the income generated by the property, which is ideal for self-employed individuals, gig workers, and investors who prefer to keep business and personal finances separate.

What types of properties qualify for DSCR loans?

DSCR loans are versatile and can be used to finance a range of income-generating properties, including:

- Single-family rental homes

- Multifamily properties (2–4 units or more)

- Short-term rentals (like Airbnb)

- Commercial mixed-use buildings

- Vacation rentals

The key requirement is that the property must generate rental income.

What is the minimum down payment for a DSCR loan?

Most lenders require a minimum down payment of 20% to 25% for DSCR loans. This higher down payment helps mitigate risk for the lender since these loans don’t rely on the borrower’s personal income. Some lenders may require more for riskier properties or those with lower DSCRs.

Do DSCR loans have higher interest rates?

Generally, yes. DSCR loans tend to carry slightly higher interest rates than conventional loans due to the reduced documentation and increased lender risk. Rates can range between 7% and 10% depending on the loan size, property income, credit score, and DSCR value. That said, a strong DSCR (above 1.25) can help reduce the rate.

How fast can a DSCR loan close?

DSCR loans often have a faster closing timeline than traditional mortgages because they require fewer documents and less underwriting time. While a typical mortgage might take 30–45 days to close, a DSCR loan can close in as little as 2 to 3 weeks, assuming the property’s financials are in order.

Are DSCR loans available nationwide?

Yes, many non-bank lenders and private mortgage companies offer DSCR loans across the United States. However, loan terms, minimum DSCR requirements, and interest rates may vary by state and lender. Always check with local lenders or brokers familiar with investment properties in your target market.

Can I use a DSCR loan for a short-term rental?

Yes. Many lenders now accept short-term rental income (Airbnb, Vrbo, etc.) when underwriting DSCR loans. However, they may use an average of past income or projected income verified by a rental analysis or appraisal. Lenders want to ensure that even seasonal or variable rental properties can reliably cover their debt obligations.

Do DSCR loans have prepayment penalties?

Some DSCR loans come with prepayment penalties, especially if you pay off the loan within the first 3 to 5 years. These penalties are designed to protect lenders from losing interest income too soon. Always review the loan agreement and ask your lender if a step-down prepay penalty or yield maintenance clause applies.

Can I refinance with a DSCR loan?

Absolutely. You can use a DSCR loan to refinance an existing property to extract equity or secure better loan terms. As with purchase loans, the refinance approval is based on the property’s income and DSCR, not your personal income. Many investors use DSCR refinancing to unlock cash for new acquisitions.

Is a DSCR loan better than a traditional mortgage?

It depends on your situation. If you have a stable job and can document your income, a traditional mortgage might offer lower interest rates and a lower down payment. But if you’re an investor with solid rental income and prefer flexibility and speed, a DSCR loan might be a better fit. It’s particularly helpful when building a portfolio or when investing through an LLC.

What happens if my DSCR is below 1?

If your DSCR falls below 1, it means the property doesn’t generate enough income to cover the loan payments. Lenders see this as high risk. You may face:

- Loan rejection

- Higher interest rates

- Larger down payment requirements

To improve your DSCR, you can increase rent, reduce expenses, or wait until the property generates more income.

Can I get multiple DSCR loans?

Yes, DSCR loans are ideal for scaling portfolios, and many lenders allow investors to take on multiple DSCR loans. Since approval is based on each property’s income, you’re not limited by personal debt-to-income (DTI) ratios like with conventional loans. This allows experienced investors to grow faster.

Are DSCR loans non-recourse?

Some DSCR loans are non-recourse, meaning the lender can only seize the property in case of default—not your personal assets. However, not all DSCR loans offer this feature. If you’re investing through an LLC or business entity, always confirm whether the loan is recourse or non-recourse before signing.

What documents are needed for a DSCR loan?

DSCR loans require fewer documents than conventional loans. Typical documentation includes:

- Property lease or rental history

- Rent roll or rental analysis

- Property appraisal

- Entity formation docs (if applicable)

- Credit report

Personal financials are usually not required, making this a low-documentation loan option.

Can I use a DSCR loan through an LLC?

Yes, many lenders allow or even prefer DSCR loans to be issued in the name of an LLC or business entity. This helps separate personal and business liabilities and can provide certain tax or legal advantages. Make sure your LLC is properly formed and in good standing.

What are the risks of a DSCR loan?

While DSCR loans offer flexibility and scalability, there are risks:

- Higher interest rates can affect cash flow

- A dip in rental income can hurt your DSCR

- Property vacancy or damage may reduce income

- Some loans carry stiff prepayment penalties

It’s important to do your due diligence, run financial scenarios, and keep reserve funds in place.

Final Thoughts

DSCR loans are a great tool for real estate investors looking to qualify based on the property’s performance instead of their own income. While they offer speed, flexibility, and scalability, the higher costs and income thresholds can be a hurdle.

My advice? Run the numbers. If your rental property cash flows well and your DSCR is 1.25 or higher, a DSCR loan could be your ticket to growing your portfolio—without getting tied down by personal income requirements.

For more information, check DSCR loan requirements here.