If you’re looking to secure a loan for an investment property or commercial real estate, understanding Debt Service Coverage Ratio (DSCR) is essential. DSCR is a key factor that lenders use to assess your ability to repay a loan based on your property’s income and expenses. In this article, we’ll break down the DSCR loan requirements and explain how it impacts your loan approval process.

Key Takeaways:

- DSCR measures a property’s ability to cover its debt service with its net operating income.

- A DSCR of 1 means the property generates just enough income to cover the debt; a DSCR above 1 is ideal.

- Minimum DSCR requirements typically range from 1.20 to 1.50, depending on the lender and loan type.

- Higher DSCR improves loan terms, including better interest rates and larger loan amounts.

- Improving DSCR can be done by increasing income, reducing expenses, or refinancing the loan.

- A low DSCR may result in higher interest rates, shorter terms, or loan rejection.

- Commercial real estate loans usually have stricter DSCR requirements compared to residential loans.

What is DSCR?

Debt Service Coverage Ratio (DSCR) is the ratio of a property’s net operating income (NOI) to its total debt service (loan payments). In simpler terms, DSCR measures how well the income from your property can cover your loan payments.

It’s a critical indicator of your property’s financial health and its ability to generate enough cash flow to meet debt obligations. For more information, check here.

- Formula for DSCR:

- DSCR= Net Operating Income (NOI) ÷ Debt Service (Loan Payments)

A DSCR of 1 means the property generates just enough income to cover its debt. A DSCR greater than 1 indicates that the property generates more income than required to cover debt, which is ideal for lenders. A DSCR less than 1 suggests that the property isn’t generating enough income to cover its debt service.

DSCR Loan Approval: Key Requirements

When applying for a loan, understanding DSCR requirements for loan approval is crucial. Here are the main factors that lenders consider:

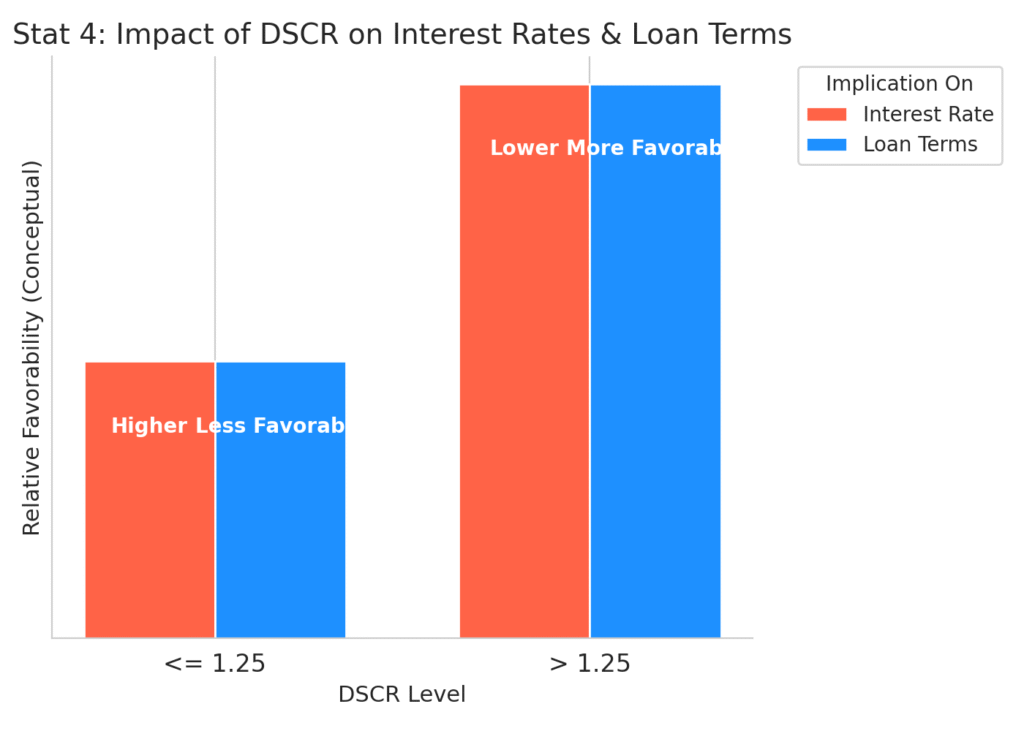

1. Minimum DSCR Requirement

Lenders typically require a minimum DSCR to approve your loan application. For most real estate loans, a DSCR of 1.25 or higher is often considered acceptable. This means that the property should generate 25% more income than needed to cover the debt service. Some lenders might approve loans with a lower DSCR, but the interest rates and terms might not be as favorable.

2. Loan Qualification Criteria

In addition to DSCR, lenders also consider other factors like your debt-to-income ratio and credit score. DSCR is just one piece of the puzzle, but it plays a big role in determining whether you’ll qualify for the loan. Lenders use this ratio to assess the loan repayment capacity of the property itself rather than your personal income.

3. Net Operating Income (NOI)

The NOI is the total income the property generates from rent or sales, minus its operating expenses. Lenders will look at your property’s NOI as part of the DSCR calculation to determine if it’s sufficient to meet the debt service. Higher NOI typically leads to a better DSCR and a higher chance of loan approval.

4. Income-to-Debt Ratio

This is the relationship between your property’s income and its debt obligations. A higher income-to-debt ratio indicates that the property is more capable of covering its debt service, making it a more attractive investment to lenders.

5. Commercial Real Estate Loans

DSCR for commercial real estate loans is often more strict compared to residential loans. Lenders for investment property loans typically require a higher DSCR (e.g., 1.25 or more) to ensure that the property can comfortably cover the debt. If you’re securing a loan for a rental property, make sure your NOI is high enough to meet these standards.

For more information, check here and here.

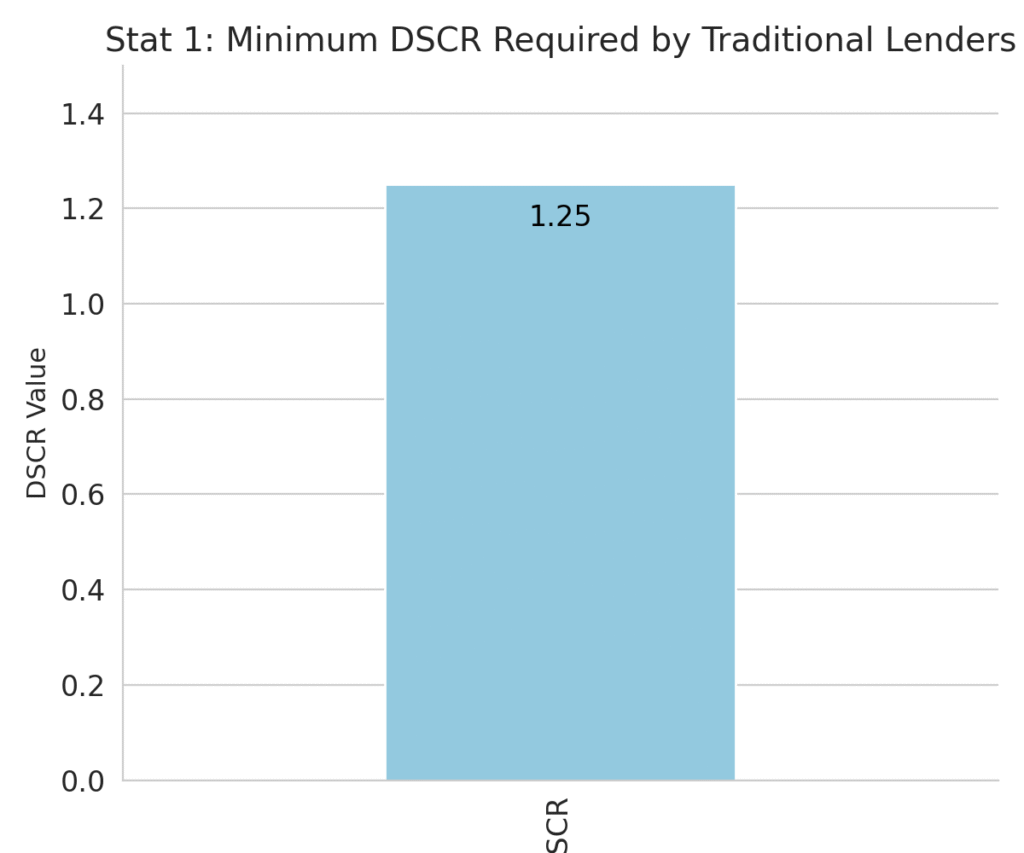

How DSCR Impacts Loan Terms

The DSCR ratio not only affects loan approval but also plays a major role in loan terms:

Interest Rates

A higher DSCR can result in more favorable loan terms, including lower interest rates. Lenders see a higher DSCR as an indication that you are a lower-risk borrower, so they may offer better financing options.

Loan Amount

The higher your DSCR, the larger the loan amount you can potentially secure. This is because lenders are more confident in your property’s ability to cover the debt service.

Loan Repayment Terms

A strong DSCR might also give you the flexibility to negotiate longer loan repayment periods, helping you reduce your monthly payments.

Improving Your DSCR for Better Loan Terms

If your DSCR is below the required threshold, there are several ways you can improve it:

1. Increase Your Property’s Income

You can increase rent, add additional services, or improve the property to attract higher-paying tenants. Increasing NOI can quickly improve your DSCR.

2. Reduce Operating Expenses

Lowering maintenance costs, utilities, and other operational expenses can increase your NOI, thus improving your DSCR.

3. Refinance Your Loan

If your current loan payments are too high, consider refinancing for more favorable terms. Lowering your debt service can improve your DSCR.

DSCR lenders: check our review about offermarket.

FAQs

What is DSCR, and why is it important for loan approval?

The Debt Service Coverage Ratio (DSCR) is a financial metric used by lenders to assess whether a property’s income is sufficient to cover its debt obligations. It is calculated by dividing a property’s Net Operating Income (NOI) by its debt service (the total amount of money required to make loan payments).

A DSCR of 1 means that the property generates just enough income to cover its debt, while a DSCR greater than 1 indicates surplus income, making it a more favorable investment for lenders.

This ratio is essential because it gives lenders a clear picture of a borrower’s ability to repay the loan based on the income generated by the property, rather than personal financial status, ensuring a lower risk of default.

What are the typical DSCR requirements for loan approval?

The DSCR requirements for loan approval vary based on the type of loan and lender, but most traditional lenders expect a minimum DSCR of 1.25 for investment properties.

This means the property should generate 25% more income than the debt service. In the case of commercial real estate loans, some lenders may require an even higher DSCR to mitigate the risk involved.

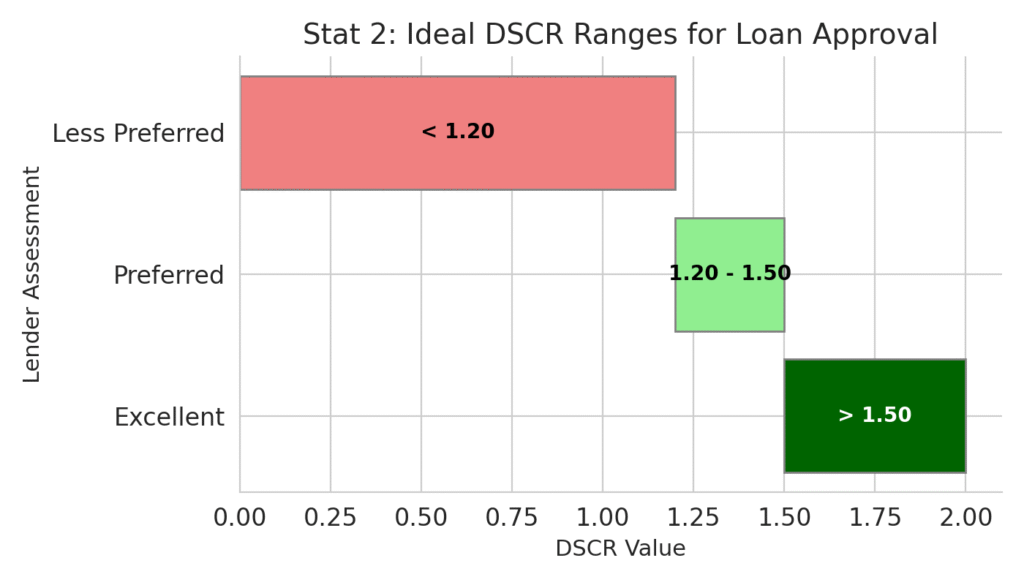

For example, if the DSCR is below 1, meaning the property cannot cover its debt obligations, a lender is likely to reject the loan application or offer unfavorable terms. Therefore, it’s critical to ensure your property generates enough revenue to comfortably meet or exceed the required DSCR.

How can I calculate DSCR for my property?

To calculate the DSCR for your property, you need to determine two key figures: the Net Operating Income (NOI) and the debt service. The formula is as follows: DSCR=Net Operating Income (NOI)Debt Service (Loan Payments)\text{DSCR} = \frac{\text{Net Operating Income (NOI)}}{\text{Debt Service (Loan Payments)}}

- Net Operating Income (NOI): This is the total income your property generates from rent or sales, minus operating expenses such as property management fees, maintenance costs, and taxes.

- Debt Service: This is the total annual amount you need to pay toward your loan, including both principal and interest.

Once you have both figures, divide the NOI by the debt service. For example, if your property has an NOI of $100,000 and an annual debt service of $80,000, the DSCR would be 1.25 ($100,000 ÷ $80,000).

How does a higher DSCR affect loan terms?

A higher DSCR typically leads to better loan terms. Lenders view a strong DSCR (greater than 1.25) as a sign of lower risk, as it indicates that the property generates enough income to cover the debt and still provides a buffer. As a result, you may benefit from lower interest rates, larger loan amounts, and more flexible repayment terms.

This is because lenders have more confidence that you will be able to meet your debt obligations, reducing the likelihood of default. Additionally, a higher DSCR can open the door to more favorable refinancing opportunities or higher leverage in future loans.

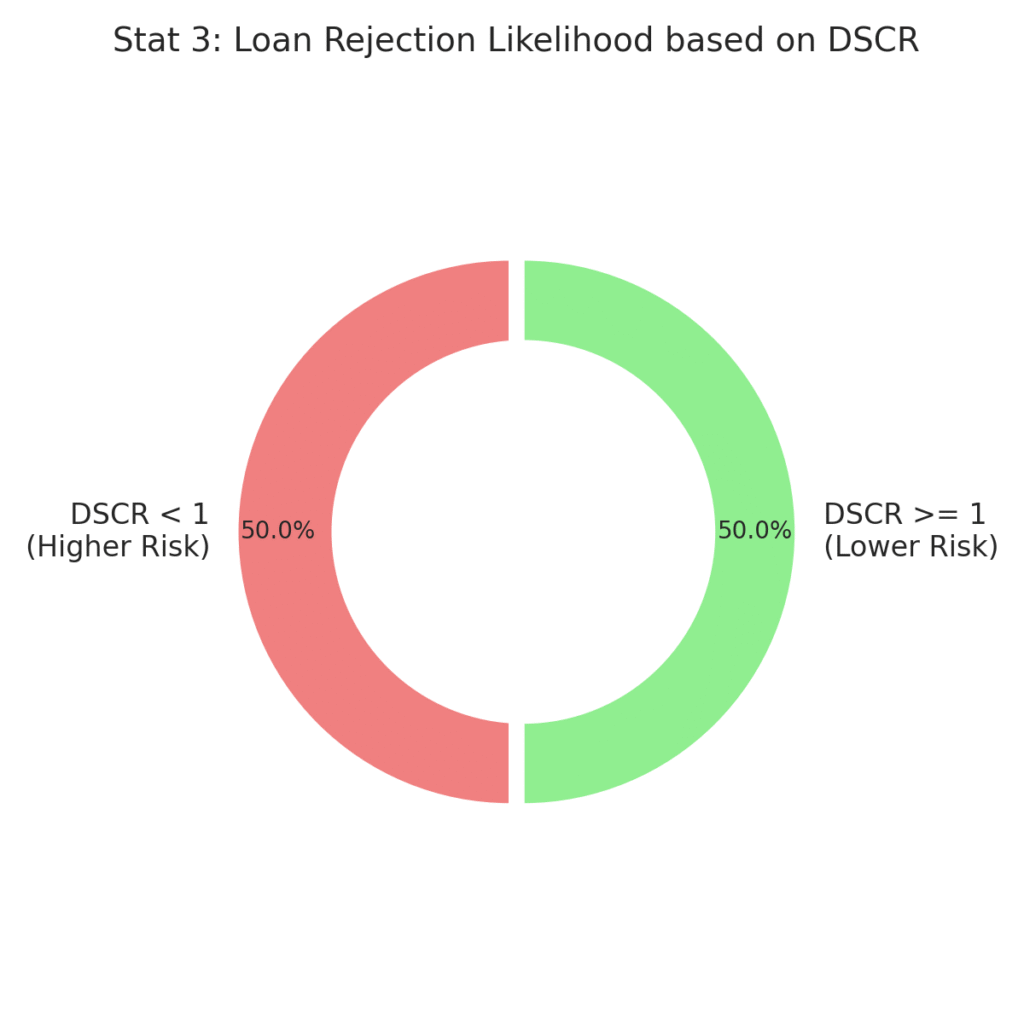

What is the ideal DSCR for loan approval?

The ideal DSCR for loan approval typically falls between 1.20 and 1.50. This means that your property should generate at least 20% to 50% more income than your debt service. A DSCR higher than 1.50 is considered excellent and signifies that your property is not only meeting its debt obligations but also generating a substantial surplus.

Lenders will be more likely to approve your loan and offer favorable terms if you meet or exceed the ideal DSCR. However, the required DSCR may vary depending on the lender and the risk profile of the property or borrower.

How can I improve my DSCR?

If your DSCR is lower than the required minimum, there are several ways to improve it. Increasing your property’s income is one of the most effective methods. You can raise rent, add additional services, or even renovate the property to attract higher-paying tenants. Another option is to reduce operating expenses. This could involve cutting costs like maintenance, property management, or utilities.

If you’re dealing with a high debt service, you might consider refinancing your loan to secure a lower interest rate or extend the repayment term, which can lower your monthly debt obligations and improve your DSCR. Additionally, if you’re purchasing a new property, look for one with high potential for positive cash flow and low operational costs.

Can I still get a loan with a low DSCR?

Securing a loan with a low DSCR can be challenging, but it’s not impossible. If your DSCR is below 1, lenders may view you as a higher-risk borrower, as the property doesn’t generate enough income to cover its debt obligations.

However, some lenders may be willing to approve loans with a lower DSCR, especially if you have a strong personal financial situation, a high credit score, or offer a substantial down payment.

Keep in mind that a low DSCR may lead to higher interest rates, shorter loan terms, or the need for personal guarantees. In such cases, it’s essential to show the lender that you have a solid plan for improving the property’s financial performance or increasing its rental income.

How does DSCR affect rental property loans?

When it comes to rental property loans, DSCR plays a crucial role in determining loan approval and terms. Since rental income is the primary source of repayment for these loans, lenders use DSCR to gauge whether the property’s rental income can reliably cover the loan payments.

Generally, lenders expect a DSCR of 1.25 or higher for rental property loans, although some may accept a lower DSCR depending on the property’s location, the borrower’s financial strength, and the loan type.

If you are securing a loan for a rental property, it’s important to ensure that your NOI is sufficient to meet the debt service, as this will directly impact your loan terms and the likelihood of approval.

What are the consequences of a DSCR below 1?

A DSCR below 1 signifies that your property is not generating enough income to cover its debt service. This can make it difficult to secure traditional financing or lead to loan rejection from certain lenders.

If your DSCR is consistently below 1, lenders may view you as a high-risk borrower, and you may be required to make a larger down payment or offer collateral to secure the loan. Additionally, you may face higher interest rates and less favorable loan terms.

To mitigate these risks, it’s essential to either increase the property’s NOI, reduce operating expenses, or restructure the debt to improve your DSCR and meet the lender’s requirements.

How does DSCR impact commercial real estate loans?

For commercial real estate loans, DSCR is an even more critical factor in the approval process. Commercial properties typically require higher DSCR requirements (around 1.25 to 1.50) due to the higher perceived risk.

Since commercial properties are often subject to greater market volatility, lenders want to ensure that the property generates enough cash flow to cover the loan payments.

A strong DSCR indicates a lower likelihood of default, which makes the property more attractive to lenders. If you’re looking for a commercial real estate loan, focus on increasing your NOI and improving the financial stability of your property to meet these higher DSCR requirements.

Conclusion

Understanding DSCR loan requirements is essential for securing financing for investment properties or commercial real estate. By calculating your DSCR, improving your NOI, and ensuring you meet the minimum DSCR for loan approval, you increase your chances of getting approved for a loan with favorable terms. Lenders use DSCR to assess your property’s financial health, and a higher DSCR generally leads to better loan conditions.

If you’re unsure about your DSCR or need help calculating it, consider working with a financial advisor or lender who can guide you through the process. Improving your DSCR can lead to more lucrative investment opportunities and financial success in the long run.