When you’re analyzing the financial health of a business, especially in the context of borrowing or investing, two common metrics often come up: Debt Service Coverage Ratio (DSCR) and Interest Coverage Ratio (ICR). These ratios are both used to measure a company’s ability to pay its debts, but they look at different aspects of financial performance.

In this post, I’ll break down both ratios, explain how they’re calculated, show you when to use them, and help you understand which one is more appropriate depending on the situation.

Quick Comparison Table: DSCR vs ICR

| Feature | DSCR (Debt Service Coverage Ratio) | ICR (Interest Coverage Ratio) |

|---|---|---|

| Definition | Measures ability to pay all debt obligations (interest + principal) | Measures ability to pay only interest expenses |

| Formula | Net Operating Income / Total Debt Service | EBIT / Interest Expense |

| Used By | Lenders (especially in real estate and long-term lending) | Investors and analysts (short-term debt focus) |

| Focus | Covers full debt repayment | Focuses on interest payments only |

| Threshold for Healthy Ratio | Above 1.2 (1.5+ preferred) | Above 2 (higher is better) |

| Includes Principal? | Yes | No |

| Preferred For | Loan underwriting, real estate, project finance | General business analysis, short-term solvency |

What is DSCR?

Debt Service Coverage Ratio (DSCR) measures a company’s ability to pay both interest and principal on its debt. It’s commonly used by lenders to determine if a business can afford a loan.

DSCR Formula:

DSCR = Net Operating Income / Total Debt Service

- Net Operating Income (NOI): Revenue minus operating expenses (before interest and taxes).

- Total Debt Service: Total amount of interest and principal due in a given period.

Example:

If a company earns $500,000 in NOI and has to pay $400,000 in debt service:

DSCR = 500,000 / 400,000 = 1.25

This means the company earns 1.25 times what it needs to cover its debt – a good sign for lenders.

What is ICR?

Interest Coverage Ratio (ICR) measures a company’s ability to pay just the interest on its debt. It helps assess short-term financial strength and is used more in day-to-day financial analysis and by equity investors.

ICR Formula:

ICR = EBIT / Interest Expense

- EBIT (Earnings Before Interest and Taxes): A measure of a firm’s profit that excludes interest and income tax expenses.

- Interest Expense: Total interest payments on outstanding debt.

Example:

If a company has EBIT of $300,000 and interest expense of $100,000:

ICR = 300,000 / 100,000 = 3.0

An ICR of 3 means the company earns three times what it needs to cover its interest payments – a strong indicator of financial stability.

When Should You Use DSCR vs ICR?

Here’s a quick guide:

Use DSCR When:

- You’re evaluating a business loan or mortgage.

- You want to know if the company can repay principal and interest.

- You’re working in real estate finance, private equity, or project finance.

Use ICR When:

- You’re doing general financial analysis.

- You only care about the company’s ability to cover interest payments.

- You’re analyzing short-term financial health or creditworthiness.

DSCR vs ICR in Practice

Imagine you’re a bank deciding whether to approve a $1 million loan to a construction company:

- The company has an annual NOI of $150,000.

- The total debt service for the loan will be $120,000 per year.

- The annual interest portion is $60,000.

DSCR = 150,000 / 120,000 = 1.25

ICR = (EBIT of 150,000) / 60,000 = 2.5

Both ratios suggest the company is in a decent position to manage the loan, but DSCR gives a fuller picture since it considers principal repayment too.

Why These Ratios Matter

- Investors use them to gauge risk.

- Lenders use them to approve or deny loans.

- Businesses use them to stay financially healthy and avoid over-leveraging.

Low DSCR or ICR values could signal that a company is struggling to meet its obligations, which increases the risk of default. High values show financial strength and give lenders confidence.

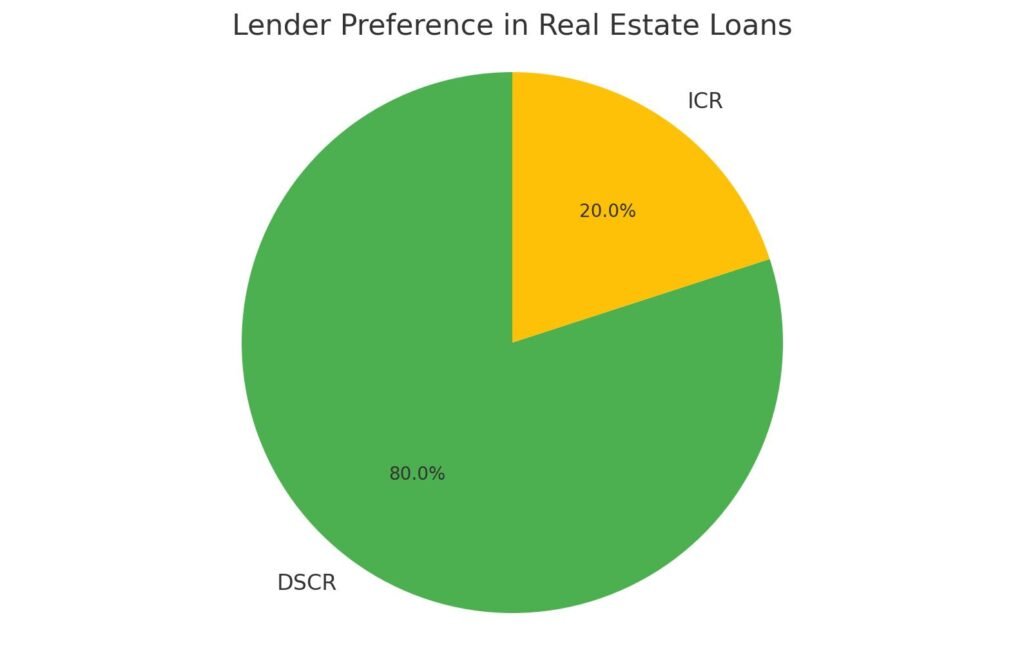

1. Over 80% of Real Estate Lenders Prioritize DSCR Over ICR in Loan Approvals

This highlights the industry-wide reliance on DSCR when evaluating property-backed loans and commercial mortgages.

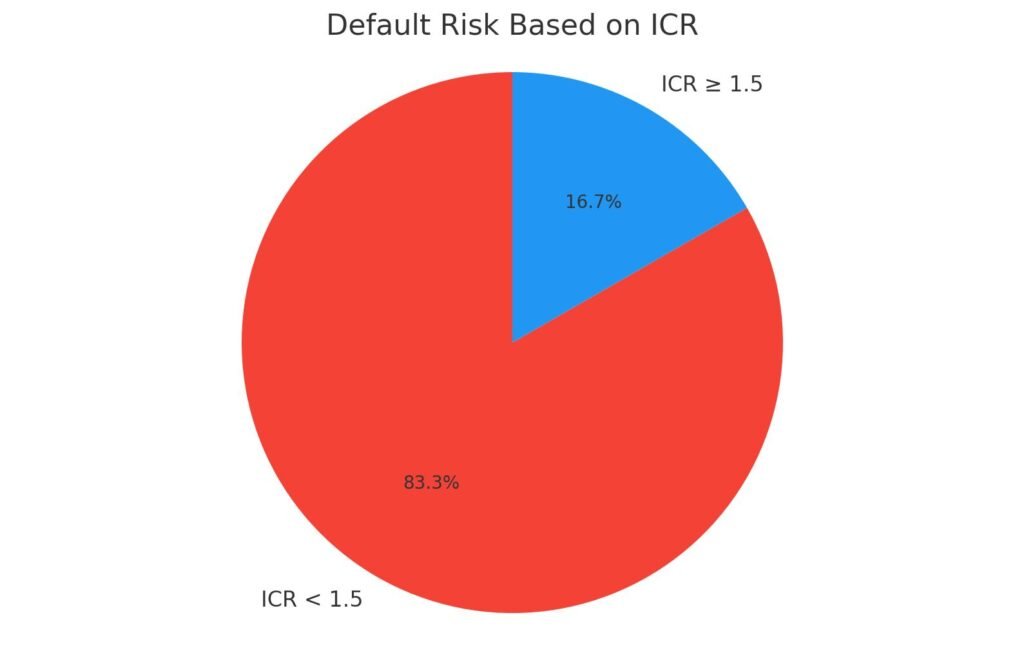

2. Companies With an ICR Below 1.5 Are 5 Times More Likely to Default on Debt

This stat emphasizes the importance of maintaining a healthy interest coverage ratio to avoid financial distress.

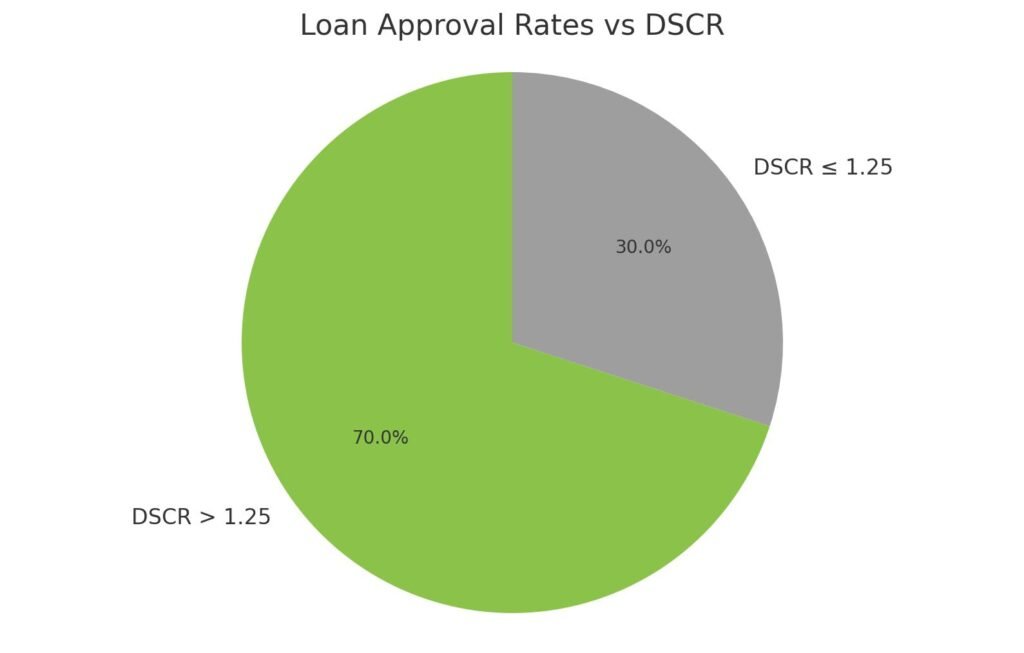

3. A DSCR Above 1.25 Is Linked to 70% Higher Loan Approval Rates Among Small Businesses

This shows the positive correlation between strong DSCR scores and favorable lending decisions in the SME sector.

Check DSCR Loan vs Bridge Loan. Also, compare DSCR Loan vs HELOC.

FAQs

What is the main difference between DSCR and ICR?

The key distinction between DSCR (Debt Service Coverage Ratio) and ICR (Interest Coverage Ratio) lies in the breadth of debt obligations they assess. DSCR evaluates a borrower’s total ability to repay both interest and principal, providing a holistic measure of financial health. Conversely, ICR measures a company’s capacity to pay only interest expenses from its earnings before interest and taxes (EBIT). DSCR is widely used in loan underwriting, credit risk assessment, and long-term debt analysis, while ICR is more relevant for assessing short-term liquidity and profitability.

Why is DSCR more relevant in real estate and project finance?

DSCR is crucial in real estate, infrastructure, and project-based lending because it reflects a project’s ability to generate enough cash flow to cover all debt obligations, not just interest. These industries rely heavily on predictable cash inflows and structured loan amortization, making DSCR a critical financial metric in risk modeling, investment evaluation, and commercial loan approval processes.

How do you interpret a DSCR of less than 1?

A DSCR below 1 indicates insufficient net operating income to cover debt payments, meaning the business is financially stressed or operating at a deficit. For example, a DSCR of 0.85 suggests the business can only repay 85% of its debt service, signaling potential default risk or negative cash flow issues. Financial analysts and lenders consider such a ratio as a warning sign for insolvency, prompting further scrutiny or loan denial.

What is considered a strong ICR ratio?

An ICR greater than 2 is generally viewed as favorable, showing that a company earns at least twice its annual interest expenses. It signals creditworthiness, healthy operating income, and robust interest coverage. For capital-heavy industries, such as manufacturing or utilities, even higher ICRs are often required to meet financial covenant standards and to instill lender confidence.

Can a company have a high ICR but a low DSCR?

Yes, a company might report a high ICR, meaning it can easily pay interest, while having a low DSCR due to heavy principal repayments. This discrepancy suggests limited free cash flow and may expose the business to long-term liquidity constraints. Balance sheet analysis and comprehensive debt modeling are necessary to understand this imbalance.

What does a DSCR of 1.0 mean?

A DSCR of 1.0 indicates a break-even point where the company’s net operating income is exactly equal to its debt obligations. While technically meeting repayment requirements, this offers no safety margin, making the company vulnerable to market disruptions, revenue dips, or interest rate increases. Lenders often require a DSCR cushion (e.g., 1.2 or higher) to mitigate default probability.

How does EBITDA differ from EBIT in these ratios?

EBIT (Earnings Before Interest and Taxes) is the traditional metric used for ICR because it reflects operating performance before financing and tax decisions. EBITDA, which also excludes depreciation and amortization, is a proxy for operational cash flow and is sometimes used in alternative DSCR calculations. However, DSCR usually relies on Net Operating Income (NOI) for greater accuracy in cash flow-based lending.

Is DSCR or ICR better for evaluating a startup?

For startups with limited or no principal obligations, ICR is typically more applicable, as it gauges the company’s ability to pay interest using operational earnings. Since many early-stage companies operate at a cash burn phase, DSCR may not provide meaningful insight. Investors and VCs often use ICR alongside burn rate, runway, and funding forecasts when evaluating startup viability.

What factors can cause DSCR to decline?

Declining DSCR values can stem from several sources: falling revenues, increasing operating expenses, higher interest rates, balloon payments, or short-term refinancing. Poor financial forecasting and ineffective capital allocation can also impact debt servicing capacity. Monitoring DSCR is vital in financial planning, budget management, and credit rating analysis.

What is a good DSCR for a small business?

For small businesses, a DSCR of 1.25 or above is often the benchmark required by banks and credit unions. This ratio reflects a 25% income buffer over debt payments, which is essential for financial resilience and loan eligibility. Industries with volatile cash flows may need even higher DSCR thresholds to maintain lender trust.

Can DSCR be negative?

Yes, when net operating income is negative, DSCR becomes negative too — a strong signal of financial distress. A negative DSCR suggests that the company not only fails to cover debt payments but also runs at a loss, which could trigger loan defaults, bankruptcy, or urgent financial restructuring efforts.

How frequently should I calculate DSCR and ICR?

These financial health indicators should be assessed monthly, quarterly, or annually, depending on the organization’s risk exposure and reporting obligations. Companies with high leverage or fluctuating income streams may need to track debt coverage metrics regularly to maintain internal controls and ensure financial covenant compliance.

Do banks use DSCR or ICR to approve loans?

Most banks prioritize DSCR in loan underwriting — especially for long-term, amortized loans or real estate mortgages. DSCR is often embedded in loan agreements as a covenant ratio, while ICR might be reviewed as a supplemental measure to evaluate the company’s near-term ability to meet interest expenses. Both play a role in the credit evaluation process.

Is a high ICR always a good sign?

Not necessarily. While a high ICR (e.g., above 5) indicates strong interest coverage, it could also suggest under-leveraging — a missed opportunity to optimize capital structure using affordable debt. In strategic finance, it’s important to maintain a balanced debt-to-equity ratio that supports growth while controlling risk exposure.

How can a business improve its DSCR?

Strategies to boost DSCR include increasing revenues, reducing operating costs, negotiating lower interest rates, or extending loan terms. Improving operating efficiency, optimizing working capital, and avoiding unnecessary capital expenditures are also effective ways to enhance debt servicing capacity and build financial flexibility.

How is ICR impacted during economic downturns?

During recessions, earnings typically fall, which directly compresses ICR. This reflects increased default risk, especially for companies with high fixed obligations. Maintaining a robust ICR cushion through conservative debt management, flexible repayment terms, and cost controls becomes critical in weathering macroeconomic instability.

Can non-profit organizations use DSCR and ICR?

Yes, these metrics are useful for non-profits, especially those managing donor-funded capital projects or debt-financed infrastructure. By tracking DSCR and ICR, non-profits can assess whether their operational revenues (like grants or donations) are sufficient to cover loan servicing requirements, thus ensuring sustainable financial practices.

What role does taxation play in ICR calculations?

ICR calculations are based on pre-tax earnings (EBIT) to provide a clearer picture of operational strength, free from the distortion of tax strategies or deferred tax liabilities. This neutrality makes ICR a universally comparable financial ratio, particularly across international operations with varied tax codes.

Are DSCR and ICR useful in personal finance?

Yes, individuals managing multiple loans or mortgages can use personal versions of DSCR and ICR to gauge personal debt affordability. For example, dividing total income by all loan payments helps assess household cash flow, while dividing income by interest expenses indicates interest burden tolerance — useful in personal budgeting and loan qualification.

Should DSCR and ICR be used together?

Definitely. Using both DSCR and ICR offers a complementary analysis of solvency and liquidity. While DSCR reflects the business’s full debt burden, ICR zooms in on the ability to cover just interest expenses. Together, these ratios offer a multi-dimensional view of financial strength, crucial for stakeholders, CFOs, and financial analysts making strategic decisions.

Final Thoughts

Both DSCR and ICR are vital tools in the world of finance, but they serve different purposes:

- DSCR is more comprehensive — it’s the go-to for lenders and long-term financing decisions.

- ICR is more focused — perfect for short-term analysis and internal performance review.

Knowing when and how to use each will help you make smarter financial decisions, whether you’re running a business, managing investments, or working in finance.