New Silver is a financial technology company that offers short-term real estate loans. It helps real estate investors finance fix-and-flip projects, rental properties, and ground-up construction.

This review breaks down New Silver’s features, benefits, drawbacks, and user opinions in simple terms, with a focus on clarity and SEO best practices.

Key Takeaway:

- Fast loan approval: Applications can be approved in minutes online.

- Investor-focused loans: Offers fix-and-flip, rental, and construction financing.

- Transparent terms: Rates, fees, and timelines are clearly presented.

- Technology-driven: Simple digital application and loan tracking.

- Best for experienced investors: Ideal for quick closings and property flippers.

What is New Silver?

New Silver provides real estate loans. It focuses on speed and ease of access. The platform uses technology to speed up loan approvals, often within minutes. Investors can apply online and get fast decisions.

Key Features of New Silver

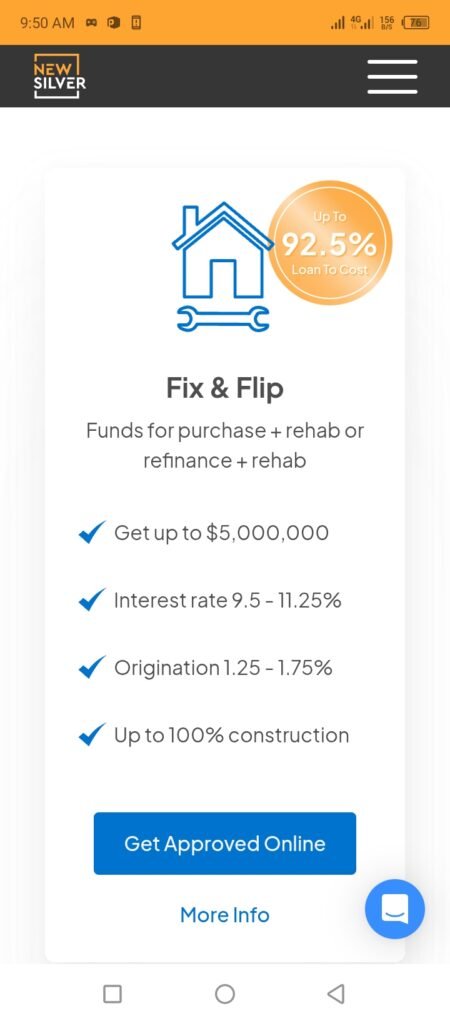

- Fix-and-flip loans: Designed for short-term rehab projects. Learn more here.

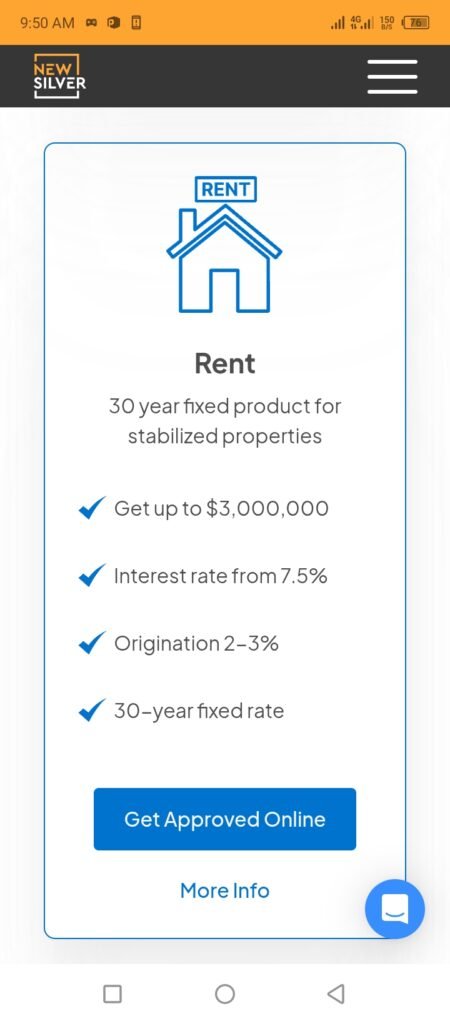

- Rental property loans: Help investors finance income-producing properties.

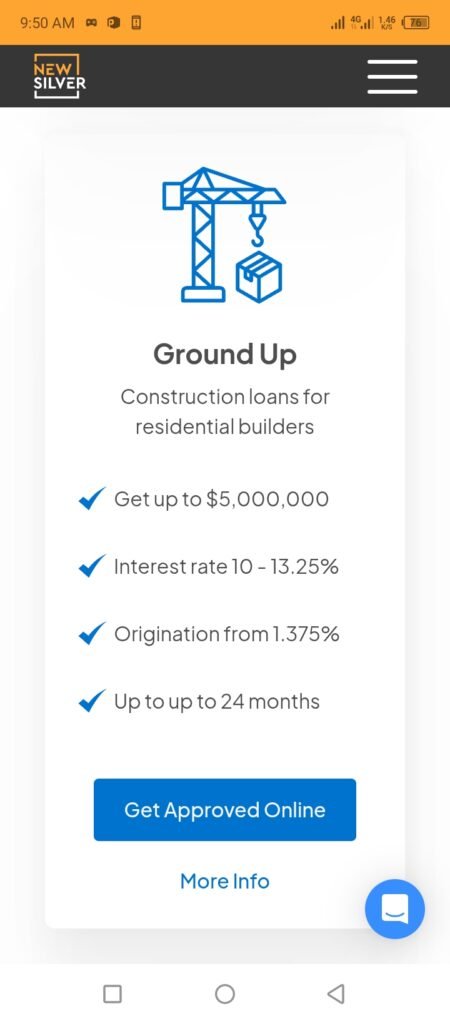

- Construction loans: Fund new real estate developments.

- Fast online application: Investors can apply in under 10 minutes.

- Instant DSCR calculator: Helps estimate loan qualification.

- Loan tracker: Users can see each step in the approval process.

Pros of Using New Silver

- Quick approvals: Many loans are pre-approved instantly.

- Online platform: Everything happens digitally—no paperwork.

- Investor-focused: Built for property flippers and landlords.

- Loan flexibility: Offers various loan types and term lengths.

- Transparency: Rates, fees, and terms are clearly listed online.

To compare benefits, visit DSCR Loan Pros and Cons.

Cons of New Silver

- Strict property criteria: Not all properties qualify.

- Higher interest rates: Compared to traditional banks, rates may be higher.

- Limited service area: New Silver only operates in select U.S. states. View locations.

- Short repayment periods: Some loans may require fast payback.

What Users Say

User feedback shows:

- Flippers love the fast approval and digital process.

- Landlords like the DSCR loan options for rental property financing.

- First-time users say the platform is easy but recommend comparing rates.

Overall average rating: 4.3 out of 5 stars

Check out how it compares in this OfferMarket Review.

Who Should Use New Silver?

- Experienced flippers who need fast financing.

- Buy-and-hold investors looking for DSCR rental loans.

- Developers starting new construction projects.

New Silver vs Other Lenders

| Feature | New Silver | Kiavi | LendingOne |

|---|---|---|---|

| Application time | Under 10 mins | 15–30 mins | 15–30 mins |

| DSCR loans available | Yes | Yes | Yes |

| Speed of funding | 5–10 days | 7–14 days | 7–14 days |

| Interest rates | Mid to High | Medium | Medium |

| Location coverage | Limited states | Nationwide | Nationwide |

For more lender options, visit Best DSCR Lenders.

FAQs

What is New Silver?

New Silver is a private lender that provides real estate investment loans. It offers short-term financing for property investors, including fix-and-flip and DSCR loans.

Who can apply for a loan with New Silver?

Real estate investors, including individuals, LLCs, and corporations, can apply. You don’t need a high credit score, but your project should show potential for profit.

What types of loans does New Silver offer?

New Silver offers:

- Fix-and-flip loans

- DSCR loans for rental properties

- Ground-up construction loans

- Bridge loans

What is the minimum DSCR required for rental loans?

New Silver generally requires a DSCR of 1.2 or higher for rental property loans to qualify.

How fast is the approval process?

The approval process can be completed in a few minutes online. Once approved, funds are usually available within a few days.

Does New Silver check credit scores?

Yes, but credit score is not the only factor. Property value, project profitability, and experience also influence approval.

What are the interest rates?

Rates depend on the loan type, term, and borrower’s profile. Fix-and-flip loans typically start at around 9%.

Is there a minimum loan amount?

Yes. New Silver’s minimum loan amount is usually $100,000, though it may vary by state.

Where is New Silver available?

New Silver offers loans in multiple U.S. states.

Are there prepayment penalties?

Some loans may have prepayment penalties. Always check the terms before signing.

Can beginners apply?

Yes, but New Silver prefers borrowers with some experience. It is best suited for investors who have completed past projects.

What is the loan term length?

Fix-and-flip loans typically have 12-month terms, while DSCR rental loans can go up to 30 years.

What fees should I expect?

Expect origination fees, closing costs, and possibly prepayment penalties. All fees are listed upfront during the offer process.

How does the DSCR loan from New Silver work?

The DSCR loan is based on property cash flow. A DSCR above 1.2 shows the property earns more than enough to cover loan payments.

How is New Silver different from traditional lenders?

New Silver uses a tech-based platform for faster decisions and does not require W-2s or personal income documentation, unlike banks.

Is New Silver better than other DSCR lenders?

New Silver ranks high for speed and convenience, especially for investors who value fast funding.

Is there a review of OfferMarket available?

Yes, reviews of similar platforms are available online for comparison with New Silver.

What are the pros and cons of New Silver?

New Silver offers quick approvals and tech-driven processes, but may charge higher rates than banks.

Does New Silver offer hard money loans?

Yes. They offer hard money loans for fix-and-flip projects with fast closings.

Can I refinance with New Silver?

Yes, you can refinance short-term loans or switch to a DSCR loan if the property qualifies.

Would you like me to turn this FAQ section into a downloadable file?

Final Thoughts

New Silver is a smart option for real estate investors who need fast, flexible funding. The platform is tech-driven and offers an easy loan process, especially for DSCR and fix-and-flip projects.

It’s not ideal for everyone. If you’re looking for low interest rates and long-term loans, a traditional lender may be better. But for quick closings and investment-focused lending, New Silver works well.

You can also review the DSCR Loan Requirements before applying.